Humans have always been attracted to the coast and other hazardous areas, and they have always found ways to adapt. What has changed in the past 60 years or so is the degree to which the federal government has facilitated enormous growth in hazardous areas, growth that is often occurring in much more hazardous circumstances than would otherwise have occurred. This ill-considered growth has occurred through massive public works projects that built protective structures such as levees; subsidization of insurance; and massive infusion of dollars into recovery efforts, all of which have served to make inherently hazardous areas seem less so.

The “safe government paradox”

Major legislative initiatives in hazard management have followed hard on major catastrophic storms or other disasters. The NFIP was no different and was enacted after costly hurricane reconstruction efforts associated with Hurricane Betsy, which struck New Orleans in 1965, in an effort to spread the burden of rescue and reconstruction across a wide group of policy holders. The history of the NFIP is detailed in Platt (1999).

The NFIP was designed to reduce payout of federal dollars for flood damages, but the end result has been a very large increase in federal payments, to the point where payouts have greatly exceeded premiums in the last several years, and the NFIP has had to draw on the national treasury. The principal criticism of the NFIP has been that the burden of risk for developing in inherently hazardous areas has been shifted from the few to the many, through subsidized insurance, and in the process has made otherwise low-value property become very attractive, as part of what Burby (2006) calls the “safe government paradox”, and others refer to as a “moral hazard” (Platt, 1999).

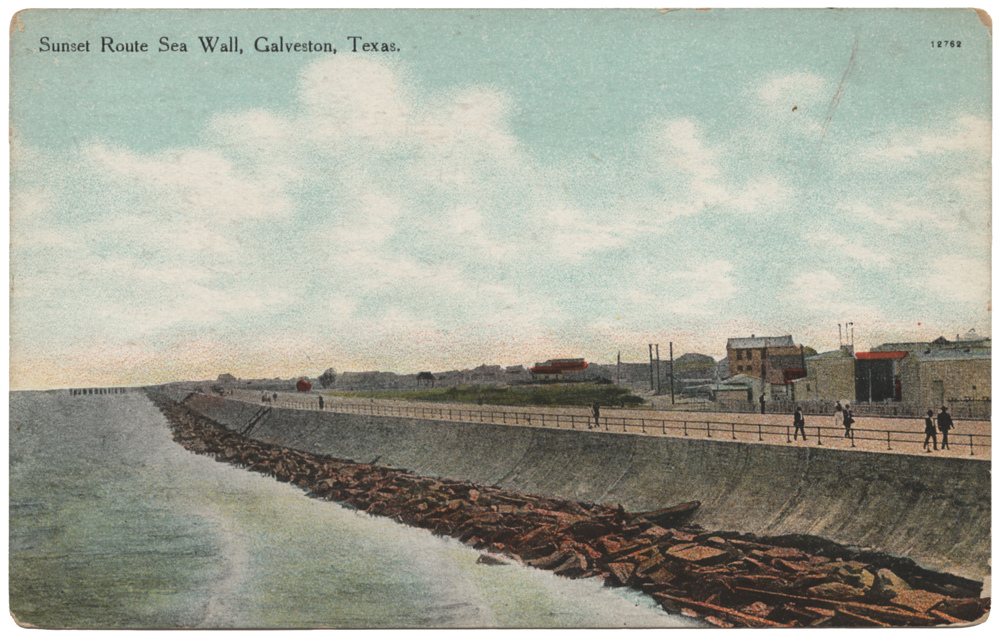

The government provides assistance for large public protection projects such as levees and seawalls and assumes much of the financial risk for development in hazardous areas through subsidized insurance. (Interestingly, flood insurance is not required in levee-protected areas). The consequences of frequent and small events are greatly reduced, but vulnerability to large and rarer catastrophic events is greatly increased (Kates et al. 2006). That those rare large catastrophic events might become less rare is a principal concern associated with changing global climate. How coastal cities will adapt to climate change through insurance is a necessary part of this discussion.

New Orleans during Hurricane Katrina as an example

New Orleans is a good case in point. It was originally settled on the high natural levees on the Mississippi River, a potentially dangerous area to be sure, but by far the safest spot near the mouth of the river (See 1863 map of the City of New Orleans). The city has been subjected to storms and floods regularly since its inception. The levee where the French Quarter and other older parts of New Orleans sits is rather narrow, and the city eventually expanded into lower and even more hazardous areas. But it wasn’t until the advent of the NFIP in the late 1960’s that development began to move rapidly into the wettest and lowest places that had been avoided for generations, such as the lower reaches of the lower 9th Ward. Development had occurred in unpropitious areas in New Orleans well before the NFIP, but the NFIP enabled rapid expansion into much worse areas by removing most of the burden of the risk associated with coastal flooding.

This story has been repeated throughout the U.S. No private insurers will insure buildings in unsafe riverine or coastal flood zones. Indeed, no insurance was obtainable until federally subsidized insurance became available.

Structural solutions: A Catch-all Fix?

It is only natural that coastal cities would want to protect development from the ravages of coastal hazards. One of the premises of federal government assistance for large protective public works is that they were necessary to protect existing development, but in most places only a few of the justified benefits for large projects were associated with existing development. In New Orleans, for example, 79 percent of the benefits from new levee building since the 1960s were for new construction that followed after the levees were built (Burby 2006).

This history and practice has clear implications for adapting to rising sea levels and increasing storms associated with global climate change. Should the government provide protection for development in areas subject to increasing risk, and assume the financial responsibility for that risk? Clearly, the unintended consequences of putting more people in harm’s way should be weighed carefully with the good intentions of “protecting” people.

Shifting the Burden of Flood Risk

How insurance is structured is itself a very real form of adaptive capacity for global climate change impacts in coastal regions (Mills, 2005), because it plays such an important role, indeed perhaps the central role, in determining what gets built where. As Mills points out, insurers have had a historical self-chosen role in addressing causal agents for a number of hazardous situations. Insurers were the founders of “the first fire departments, building codes, and auto safety testing protocols” (Mills, 2005). There is little reason to believe that private insurers would be willing to subsidize development in very hazardous areas without a government subsidy. At actuarial insurance rates, building in the coastal “V” zone (the coastal “velocity zone”, equivalent to the riverine floodway), or any flood zone for that matter, would no doubt be much more expensive than it is now.

Perhaps a case could be made that where coastal cities are truly “necessary”, such as critical port facilities at the mouths of major rivers (e.g., New Orleans) some sharing of the risk might be justified. Some kind of private-public partnership could be advisable to share what might well be a necessary risk. But considerable restructuring from the current system would be necessary to avoid the “safe government paradox” and development in ill-considered areas, beyond that needed to sustain critical facilities.

Solutions

Insuring Communities, not Individuals

Burby (2006) suggests that a fundamental shift needs to be made from insuring individuals to insuring communities. Insuring a community rather than an individual puts the responsibility where it belongs – on local government. All of the dwellings and buildings in a community would be insured, with the premium based on the risk exposure of the community. This would avoid the problem of less than full participation in the NFIP program in many communities. Burby suggests communities could pay their premiums through a floodinsurance utility operated in much the same way that storm utilities already operate in many communities. A home or business owner’s fee would be based on the amount of risk, addressing perhaps the principal problem of the NFIP — the lack of correlation between premiums and risk.

Canceling government subsidies

Canceling government subsidies altogether is frequently suggested as the best remedy for the NFIP. Private insurance for coastal areas would be much more expensive, and even unavailable at any price in some areas. The lack of insurance will not necessarily mean the cessation of all development in coastal areas. Beach house owners on Bolivar Peninsula, on the east side of Galveston Bay, for example, can easily expect payback on these houses, in terms of rental income, within five years, a period of time much shorter than the current recurrence interval of even small tropical storms and hurricanes.

Coastal populations are clearly going to be at a greater risk as a result of global climate change. The natural tendency for many well intentioned researchers and planners is to want to protect those populations from the coming impacts, through protective structures and federal assumption of the risk. But experience has shown that this is exactly opposite of the path needed to minimize damage to life and property. If left to their own devices, local populations usually have a pretty good idea of where it is prudent to build, if made responsible or liable for most of the risk. In terms of climate change, what is needed is communication about increasing risks in areas citizens already perceive as hazardous, and the need to incorporate more “freeboard”, both real and metaphorical, into their plans and buildings.

Promote Land Use Planning

The preponderance of opinion in both the academic (Burby, 2006; Godschalk, 2003; Berke and Campanella, 2006) and practitioner communities (ASFPM 2015) is that keeping people out of harm’s way through the “soft mitigation” practice of planning, particularly land use planning, is far preferable to investments in either hard protective structures or investments in community reconstruction after the fact, necessary though these last two occasionally may be.

Click here to learn more on the importance of land use planning